The following are a list of the most common bookkeeping and accounting services we perform. If your company has a service needed not listed here, we most likely know how to do it. Please let us know in the comment section of the quote form.

Bookkeeping is performed on a schedule; daily, weekly, twice monthly, monthly or annually

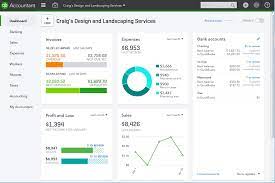

Timely and accurate financial reports delivered monthly and reviewed with your Quickbooks ProAdvisor

Data entry of banking, credit cards, payments, deposits, invoices, bill payments, etc.

Bookkeeping catch-up and clean-up if your books are in arrears

Reconciliation of bank accounts, credit cards, loans and investment accounts

Annual E-filing of 1099’s, W-2’s, 941, Sales Tax, Local Forms, Applications and much more.

- Bookkeeping Services – Daily, weekly, monthly, quarterly and annually

- Banking, credit card, loan, investment and merchant account reconciliations; Paypal, Amazon, Stripe, Square and Shopify.

- Updating the online banking to correct the bank balance to real-time.

- Accounts Payable – Coding, posting, billpay with explicit approval, recon-ciling, reporting, year end 1099’s and maintaining vendor master files.

- Accounts Receivable – Coding, posting of cash receipts & sales, invoicing, statements, reconciling, reporting, light collections by phone and mail as needed and maintaining customer master files.

- Payroll – Processing and entering payroll from a third-party of your choosing.

- Financial Reporting – Financial management reporting, budgeting, and cash flow forecasting.

- Monthly Processes: Job costing, department and class tracking, location tracking, tracking customer deposits/ retainers, income/payroll allocations, currency conversions and Accounts Receivable Financing Factoring Reconciliations.

- QuickBooks Set-up – New company initial set-up of your accounting data file using QuickBooks desktop version or QuickBooks Online.

- Clean Up / Catch Up work – If books are in arrears and need back months of bookkeeping performed.

- Form Preparations – Sales and use tax, Business License renewals, Worker’s Compensation submittals.

- Year-End Tax Filings – 1099 and 1096 compiling, filing and reporting.